One of the financial choices that can prove to be worthy when made right is selling silver coins, jewellery, or even flatware. Nevertheless, the number of sellers who commit errors is too high because they have only slight experience in silver markets and determining values. Knowledge of the way silver is priced, appraised and sold can ensure you do not lose money and at the same time obtain fair value.

Know the degrees of Purity of Silver

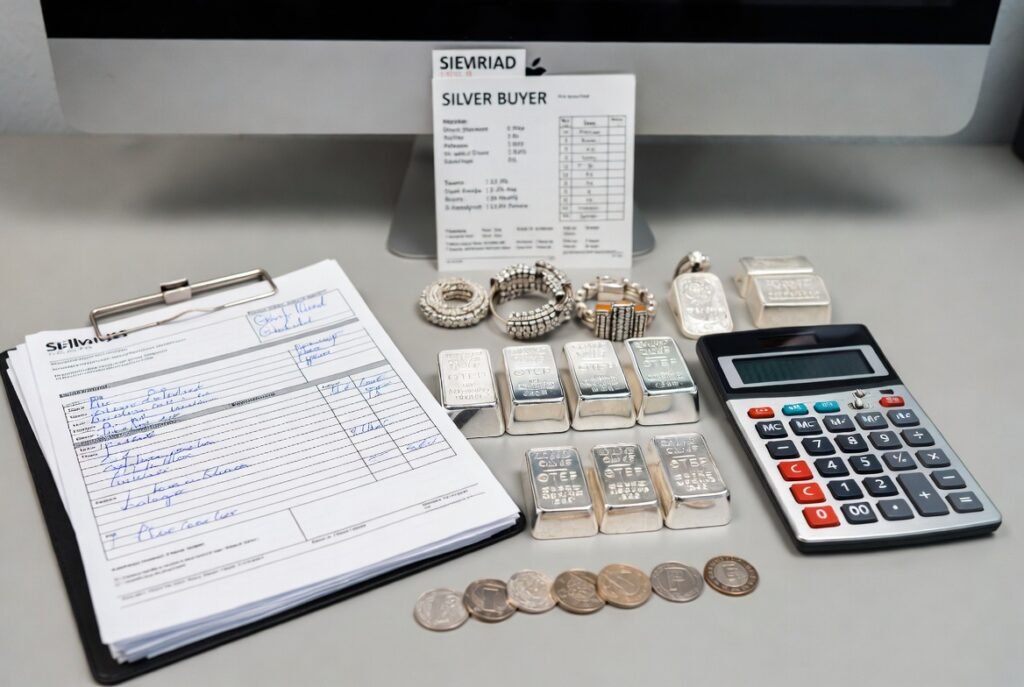

Fineness is used to measure the purity of silver, i.e. a pure silver is made of 999, and sterling silver is made of 925. Greater purity is normally associated with greater value. Silver is usually diluted in alloys in jewellery and flatware. Hallmarks and stamps denote purity.

Sensor reads the Silver Market Price

Silver prices fluctuate day in and day out according to the world market situation. Check the prevailing spot of silver before selling. This price forms a guideline for determining the base value of your items. Buyers willingly pay a percentage of the spot. Being aware of the market rates would also assist you in recognising reasonable bids and preventing low payments.

Weigh Your Silver Well

Silver valuation has a significant part in weight. Silver will normally be weighed in troy ounces and not in standard ounces. Non-silver components may be used, though, in jewellery and will influence the actual silver weight. Proper use of scales is important in order to get a correct measurement.

Single Silver-Plated Articles

Silver-plated products have very little silver content and also tend to have low value in resale. Silver-plated goods are not bought by a great number of buyers. It is time-saving and not confusing to separate the plated items with solid silver.

Knowing Collectable and Antique Value

Age, rarity, or design of some items of silver has given them added value. Old wine glasses and mints of rare coins can be more valuable than the amount of silver in them. Melt value selling of such items can be a loss.

Get Multiple Price Quotes

Do not take the first offer in comparison. Obtaining quotes from multiple buyers will assist you in knowing the market ranges. Buyers may have large price variations. Bidding offers more than the chances of getting the best deals. It also increases your bargaining ground.

Know Buyer Fees and Deductions

There are buyers who impose tests, refining or manipulation of silver. These expenses minimise your end payoff. It is better to ask about the deductions in advance to prevent any unexpected outcomes. Transparent buyers are very clear in pricing. Knowing fees will enable you to know net returns.

Get to know the difference between Melt Value and Retail Value

Melt value is the cost of silver in terms of weight and purity. Retail value encompasses the craftsmanship, branding or collectable demand. Melt value is paid by the majority of buyers, particularly for jewellery and flatware. This difference can be used to avoid disappointment and set realistic expectations.

Learn How Silver Is Tested

Silver is tested on acid tests, magnets or electronic devices by buyers. These are ways of ensuring authenticity and purity. Confidence and safeguard against false allegations are gained through knowledge of the test methods. Respectable purchasers do tests in an open manner. Knowledge of testing procedures will make you identify reputable and professional dealers.

Avoid Selling in a Hurry

Hurried decisions tend to result in reduced payout. It is better to spend time investigating prices and buyers. There is fluctuation in the market conditions, and waiting to have good prices might add value. The ability to sell in a calm and patient way is present to enable you to maximise gains as well as to evade regrets.