Tech funding slows. Money moves with caution. Investors rethink risk after sharp losses, weak exits, and rising costs. You face a tighter market with higher proof standards.

Market mood shifts fast

Public market swings set the tone for private funding. Share prices drop. Valuations reset. Investors protect capital. You feel pressure to show steady revenue and clear margins. Growth alone fails to satisfy. Boards ask harder questions. Deals take longer. Terms favor capital providers, not founders.

Rates change risk math

Higher interest rates raise safe return options. Bonds look attractive. Risk premiums rise. Tech ventures compete with predictable yield. You need stronger unit economics. Burn focused plans lose appeal. Cash discipline matters more. Runway planning gains priority during pitch meetings and follow up calls.

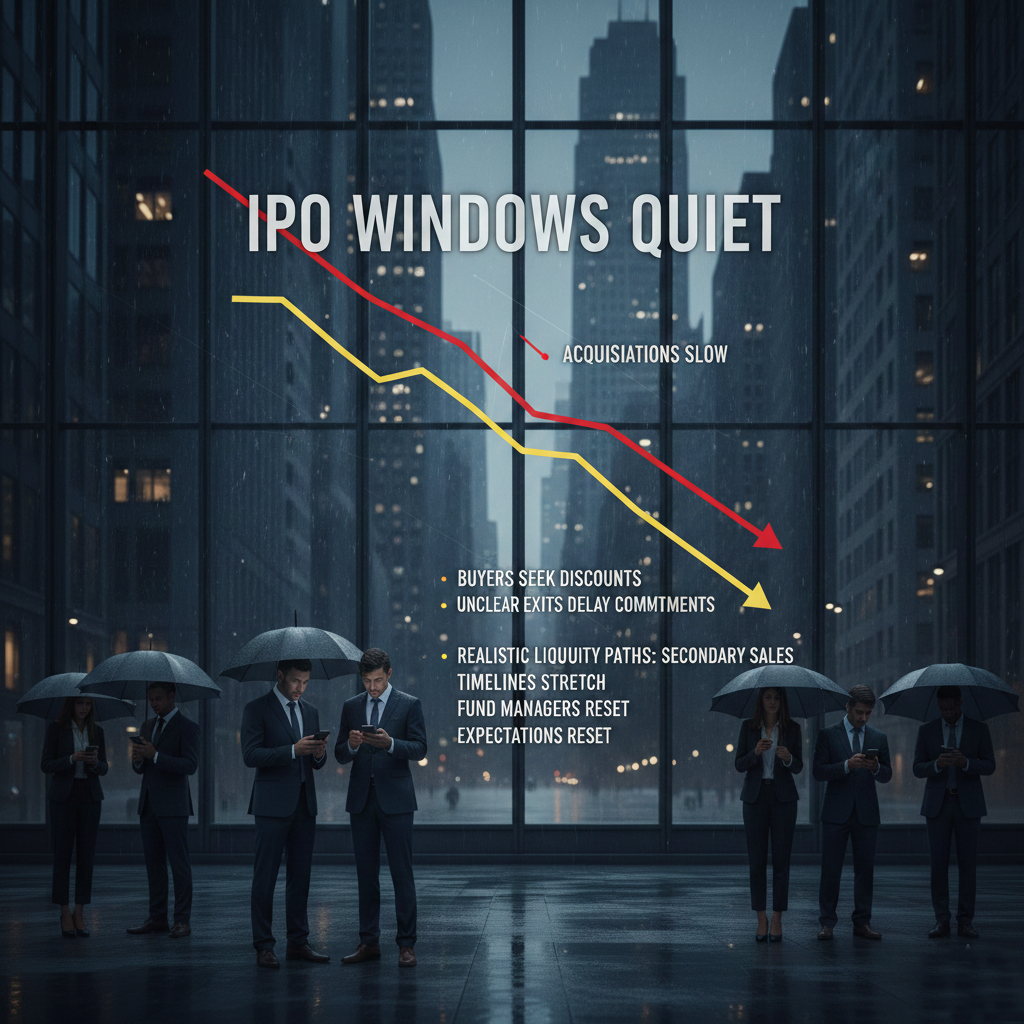

Exit paths narrow

IPO windows stay quiet. Acquisitions slow. Buyers seek discounts. Without clear exits, investors delay commitments. You must outline realistic liquidity paths. Secondary sales gain relevance. Timelines stretch. Expectations reset across portfolios. Fund managers manage pressure from limited partners.

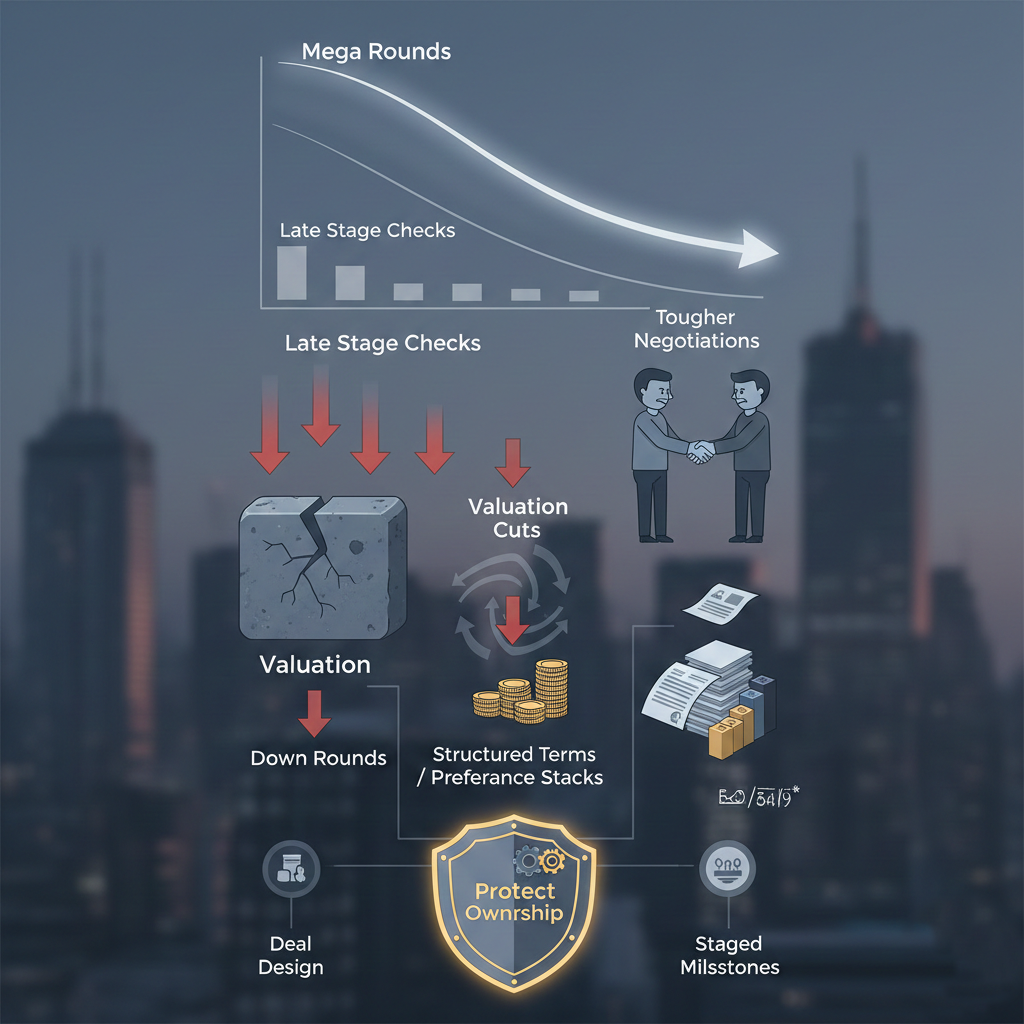

Late stage funding shrinks

Mega rounds fade. Late stage checks drop in size. Valuation cuts appear common. You face tougher negotiations. Down rounds happen more often. Structured terms increase. Preference stacks grow. You protect ownership through careful deal design and staged milestones.

Early stage is still selective

Seed capital flows, yet scrutiny rises. Investors favor founders with domain depth. Traction beats vision decks. Pilot revenue helps. Clear customer pain matters. You prepare concise proof points. Experiments with weak signals struggle. Warm intros help less than before.

AI attracts focus

Capital clusters around AI infrastructure and tools. Spending follows compute, data, and productivity gains. You align stories with measurable outcomes. Buzz without revenue fails. Buyers demand ROI. Sales cycles tighten. Benchmarks matter. Use cases drive funding interest.

Cost control wins trust

Lean teams gain favor. Hiring slows. Marketing spend trims. You show monthly burn control. Forecasts include downside cases. Investors reward discipline. Governance improves. Reporting cadence tightens. Transparency builds confidence during volatile periods.

Geography matters more

Capital concentrates in major hubs. Cross border deals slow. Local networks gain value. You strengthen regional partnerships. Regulatory clarity influences checks. Currency risk affects terms. Funds prefer familiar markets with proven exit history.

Founder mindset adapts

Storytelling shifts from growth to durability. You prioritize profitability paths. Metrics stay simple. Customer retention leads. You prepare for longer fundraising cycles. Optionality matters. Focus sharpens. Execution beats hype.

What founders do next

Prepare evidence. Shorten decks. Highlight cash plans. Show customer proof. Accept valuation realism. Build relationships early. Diversify funding sources. Extend runway. Deliver milestones. Earn trust through steady results.